What Are Small Amount Payments?

Small amount payments, often referred to as micropayments or low-value transactions, are financial transactions typically characterized by their minimal monetary value, usually ranging from a few cents to a few dollars. These payments are increasingly prevalent in various industries, particularly in digital content, online services, and e-commerce. The concept of small amount payments has gained traction due to the growth of online transactions and the increasing need for businesses to cater to consumer preferences for flexibility and convenience. As digital platforms proliferate, consumers are more inclined to engage in transactions that do not require a significant financial commitment, making small amount payments an essential aspect of modern commerce.

The Importance of Small Amount Payments

The significance of small amount payments extends beyond mere convenience; they play a crucial role in enhancing consumer engagement and promoting business sustainability. For digital content providers, such as news websites or streaming services, allowing users to make small payments for individual articles or songs can lead to increased revenue streams. This model not only enables consumers to access content without committing to a subscription but also encourages them to explore and purchase additional content. Furthermore, small amount payments can help businesses expand their customer base, as they attract price-sensitive consumers who may hesitate to spend larger sums upfront. In this way, small payments contribute to a more inclusive economy where even low-income individuals can access goods and services.

Challenges of Implementing Small Amount Payments

While the advantages of small amount payments are apparent, several challenges accompany their implementation. One significant hurdle is the transaction cost associated with processing these payments. Traditional payment systems often impose fixed fees that can consume a substantial portion of the payment amount, rendering low-value transactions unfeasible for merchants. Additionally, many payment processors may lack the infrastructure to handle micropayments efficiently, leading to delays and increased operational costs. Another challenge is the potential for fraud, as low-value transactions can be exploited by malicious actors. To combat these issues, businesses need to adopt innovative payment solutions that minimize transaction costs and enhance security, ensuring that small amount payments remain a viable option for both consumers and merchants.

The Future of Small Amount Payments

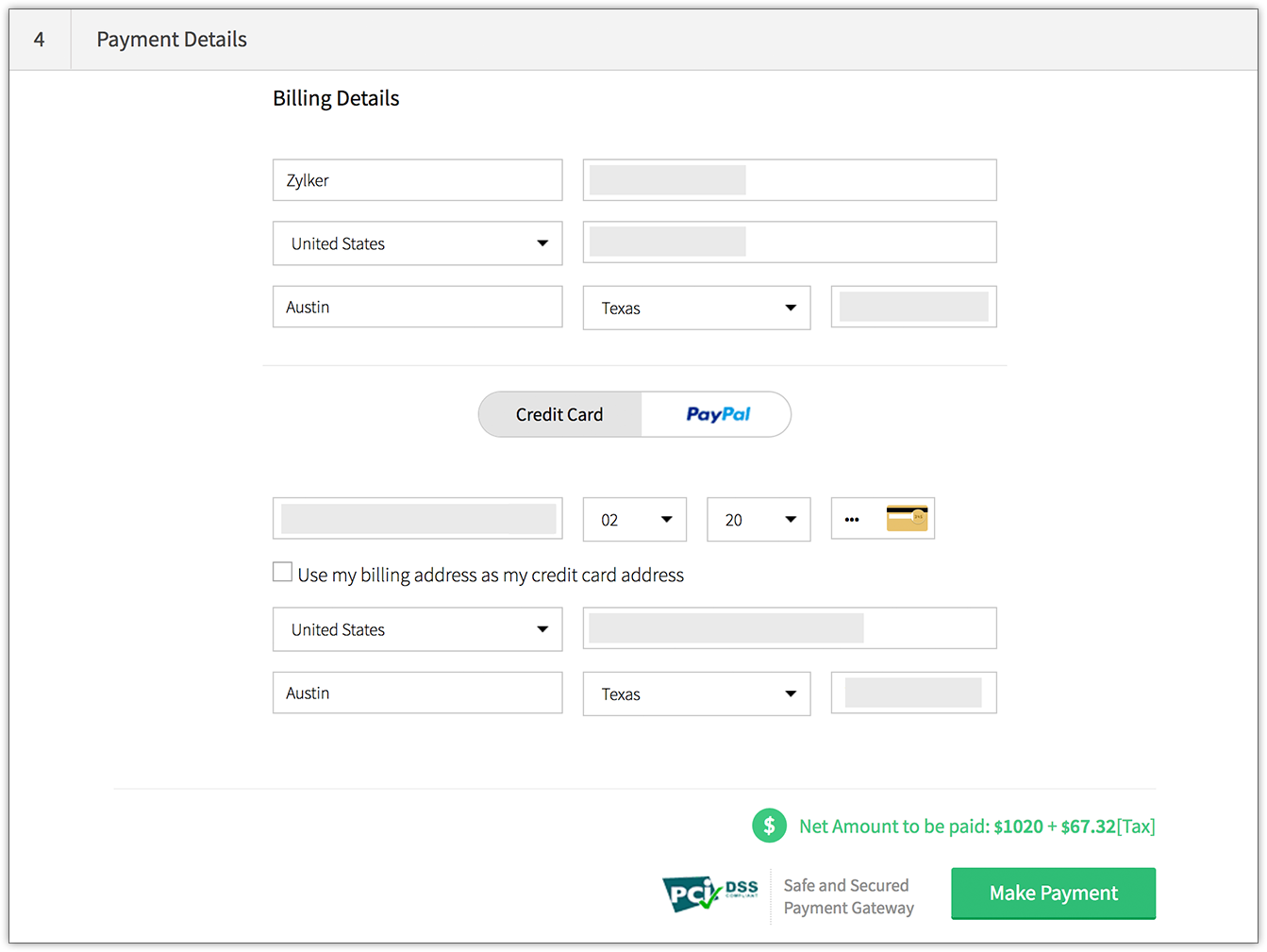

As technology continues to evolve, the future of small amount payments appears promising. The rise of digital wallets and blockchain technology offers new opportunities for facilitating micropayments. Digital wallets, such as PayPal and Venmo, allow users to make quick and seamless transactions without incurring high fees, while blockchain technology enables secure, transparent, and cost-effective micropayments through decentralized platforms. Moreover, the growing acceptance of cryptocurrencies presents an additional avenue for conducting small transactions, as these currencies often have lower transaction fees compared to traditional payment methods. As consumer demand for flexible payment options increases, businesses that embrace and adapt to the small amount payment model are likely to thrive in the evolving digital economy.

In conclusion, small amount payments represent a significant shift in the way transactions are conducted in the digital age. They provide consumers with greater access to goods and services, encourage exploration of new content, and offer businesses the potential for increased revenue. While challenges exist in implementing these payment methods, advancements in technology and payment processing will likely pave the way for a more robust and efficient micropayment ecosystem in the future.소액결제